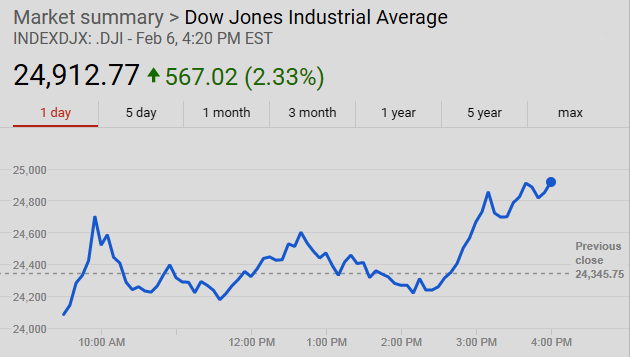

UPDATE Feb 6, 2018: Dow closes up more than 560 points, S&P 500 closes up almost 2 percent, Nasdaq closes up more than 2 percent:

|

| Photo: Sam valadi/Flickr |

SeekingAlpha.com comment Feb 3, 2018: "... there is a massive..massive amount of global institutional money on the sidelines that could not place a position because the market was too strong. U.S. M1 is up 11.8% from a year ago. This is enormously bullish. The p/e is 20x forecasted earnings. The only times the forecasted earnings fail is when monetary policy is the opposite of the forecast. That is not the case today. The BAA corporate bond is 4.34%...4.34%. In August of 1987 prior to a large sudden drop in the S&P it was 10.92%..10.92%. Think about the difference. We are in a massive bull market. No institutional investor is going to sell his equity position to switch into bonds or cash earning 1%. Besides being financial performance suicide it would be marketing suicide."UPDATE Feb 5, 2018:

So What Do I Think about the “Crash” in Stocks? | WolfStreet,com: "What’ll happen next? Dip buyers will come in, maybe at this very moment, or maybe later, and some of them will likely get plowed under, but there is way too much cash lined up in hedge funds specifically set up to profit from sell-offs."

This Is A Normal, Bull Market Correction: J.P. Morgan Strategist Gabriela Santos

CNBC video above published Feb 5, 2018: Gabriela Santos, J.P. Morgan Funds global market strategist, and Jeremy Zirin, UBS head of investment strategy Americas, discuss their investment strategies during the market sell-off.

Ray Dalio: Recent market declines are just 'minor corrections' | cnbc.com Feb 5, 2018: Dalio said, "these big declines are just minor corrections in the scope of things, there is a lot of cash on the side to buy on the break, and what comes next will be most important."

Legendary Investor Bill Miller On Dow's 500 Point Sell-Off

CNBC.com video above published Feb 2, 2018: CNBC's Brian Sullivan speaks with Bill Miller, Miller Value Partners, and Charles Ellis, Greenwich Associates, discuss the current global market environment.

Milken Institute's Lee Says Fed Doesn't Seem All That Nervous

Bloomberg.com video above published Feb 2, 2018: William Lee, chief economist at the Milken Institute, discusses the job market, Fed rate hikes and investment spending on "What'd You Miss?"